Order your food, drinks, or groceries on the mobile app, and it will be delivered to you within 30 minutes. That’s how China’s on-demand delivery service platform works today, drawing enthusiastic response from the consuming public.

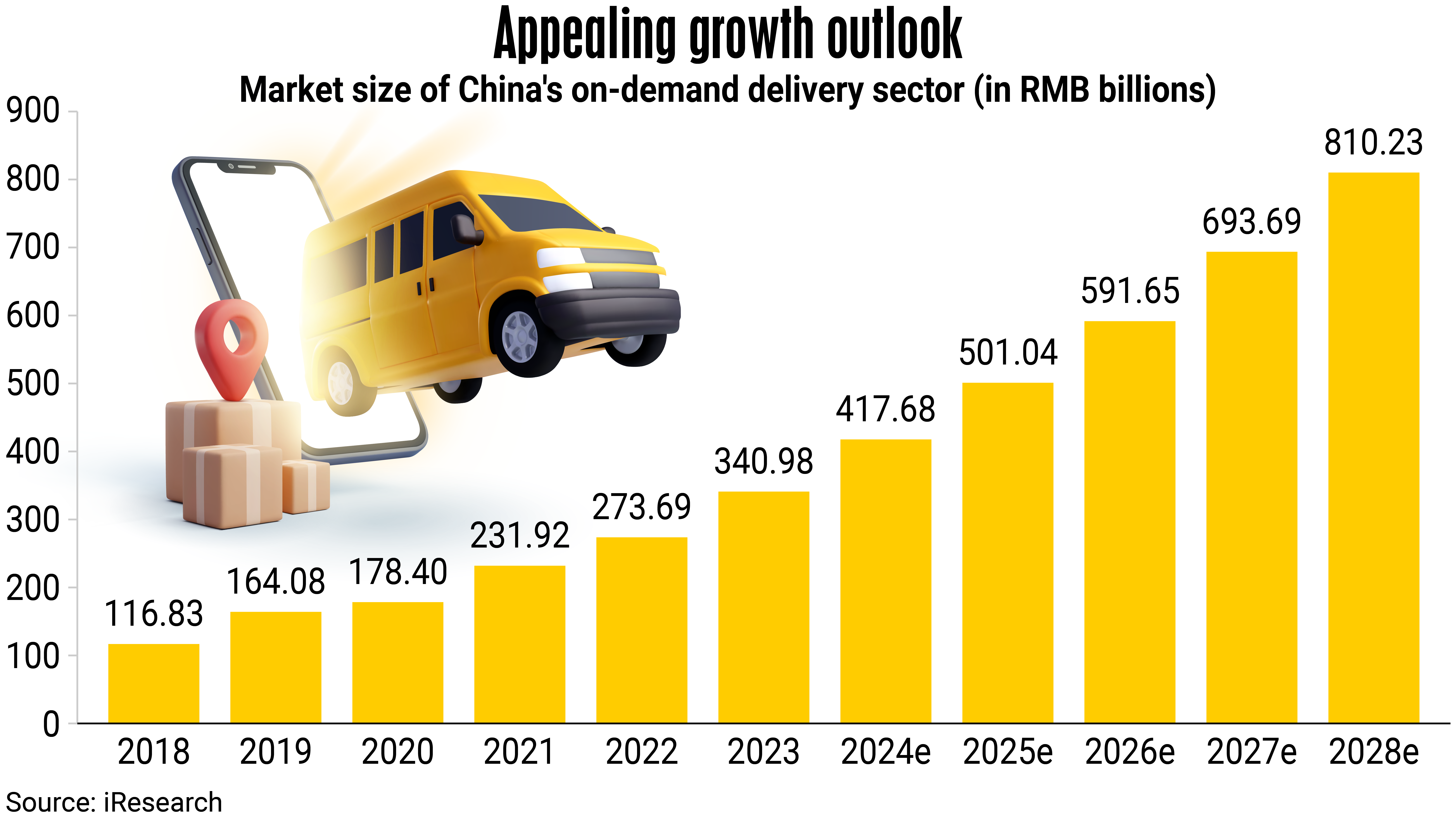

With a size of 341 billion yuan ( US$47.5 billion ) in 2023, the market for on-demand delivery in China is expected to grow further and reach 810 billion yuan by 2028, with a compound annual growth rate of 18.9%, according to estimates by market research consultancy IResearch.

Such a sizeable market with an appealing growth outlook has spurred fierce competition among the country’s retail giants. Jingdong ( JD ), famous for online retail and logistics, entered the business in February, seeking a slice of the market dominated by Meituan ( with over 65% share of the food delivery business as of 2024 ) and Alibaba’s Ele.me.

Newcomer JD follows a “growth first, profit later” strategy, muscling its way into the on-demand delivery market by offering generous subsidies to merchants and customers. Its Q1 2025 earnings report shows that its “new business” segment, which includes food delivery, achieved a net revenue of 5.7 billion yuan, up 18.1% from a year earlier, while its operating loss increased by 49.5% to 1.3 billion yuan. Read: it’s burning money to reel in customers.

Meituan’s performance during the same period is solid. Its “core local commerce” business, which encompasses food delivery, rose 17.8% year-on-year to 64.3 billion yuan, while operating profit increased by 39.1% to 13.5 billion yuan, maintaining its number one position in the on-demand delivery space.

In an earnings call, Meituan’s management says it welcomes competition but admits that increased competition could weigh on its financial performance. It expects a slowdown in revenue growth and a significant drop in operating profit for the second quarter.

However, Meituan criticizes its new rival for “irrational” competition, which it considers “unsustainable” in the long term. “We shall win the competition at all costs,” founder Wang Xing vows.

On the other hand, JD appears to be making remarkable progress in its new business. A hundred days after the launch of its food delivery service, daily orders, a key metric for on-demand delivery platforms, have been exceeding 25 million, says the company CEO. By comparison, the number for Meituan is about 90 million and for Ele.me, about 45 million. With all platforms ramping up billions of yuan in subsidies, an intensified tri-party contest is clearly emerging.

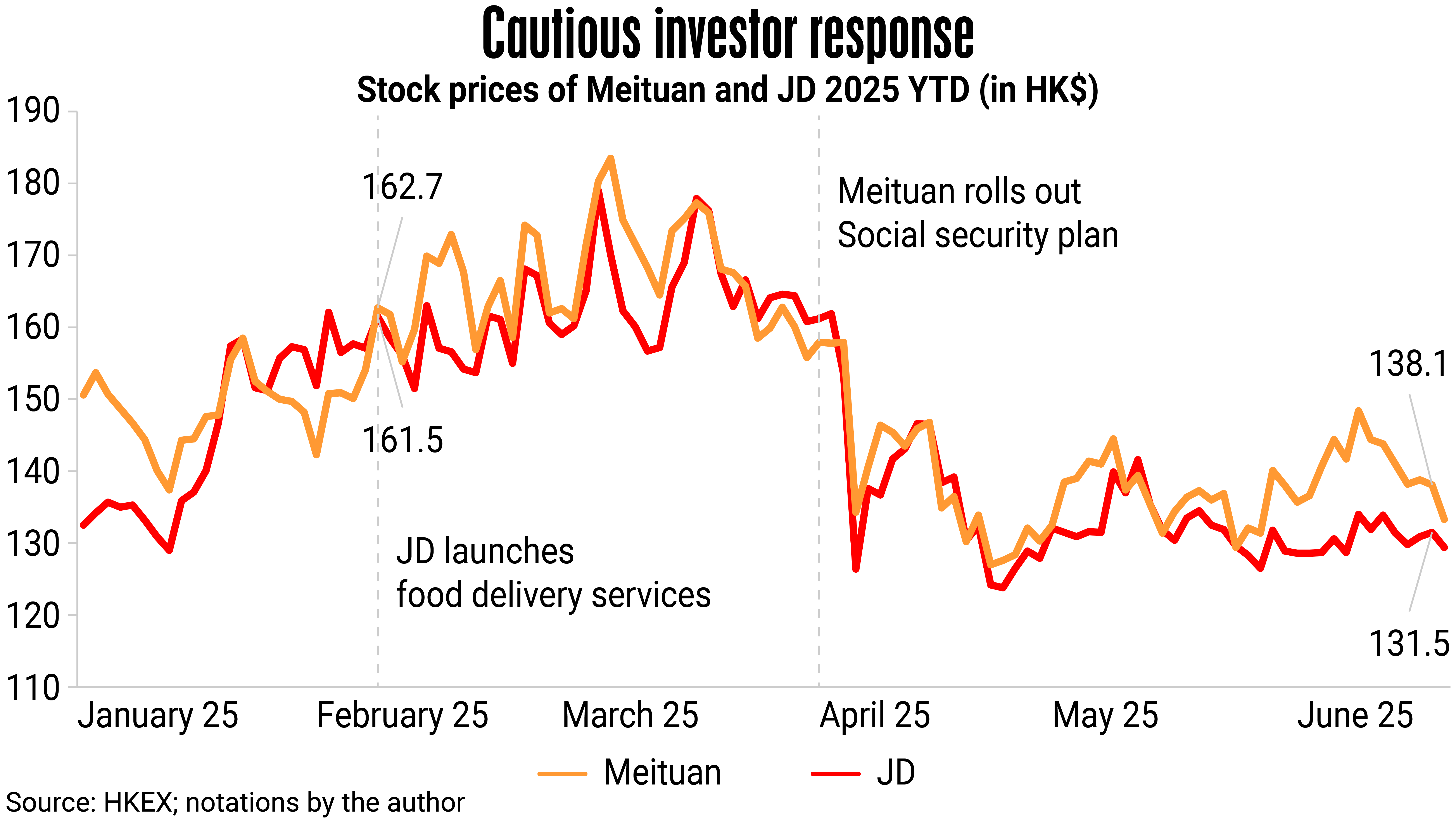

Investors remain cautious, knowing fully well that a rise in user or delivery numbers does not automatically translate to increased net income. This caution is reflected in recent stock price movements for Meituan and JD. Meituan’s shares have fallen by 20% from HK$160 ( US$20.38 ) in early February to around HK$135 in mid-June, while JD’s stock price has also tumbled from HK$155 to HK$130 over the same period.

The battle for market share is not the only factor that is affecting operating income in the on-demand delivery business. Increased regulatory requirements, particularly social security for food deliverers, are also expected to erode the platforms’ profits. As covered in an earlier article, Meituan, JD and Ele.me have announced plans to sign up their delivery workers for the national social security coverage in February/March. The impact of added costs from regulatory compliance is expected to start emerging in their earnings results in the second quarter.

While financial metrics remain paramount for investors, each platform is working hard to distinguish itself through its business model. Meituan aims to solidify its leading position by pursuing a globalization strategy and investing in new technology such as delivery drones. JD, having a solid presence in the logistics business, wants to extend its supply-chain advantages into the on-demand delivery space, while Ele.me tries to cross-collaborate with the other business units under Alibaba such as Taobao for synergy in e-commerce.

Finally, the market for on-demand delivery is also evolving. For example, the variety of goods that fall within the on-demand delivery’s time limit is expanding – from foods, drinks and groceries to pharmaceuticals and digital gadgets – as consumer demand for fast delivery opens more business opportunities. Geographical coverage and consumer demographics are also critical factors for leading players to consider when making their business strategies. Competition will only intensify further, but market participants can find competitive advantages in some vertical and niche channels.

Given all these complexities, how will things pan out going forward? The earnings results for Q2 2025 may not be able to answer all of investors’ questions, but they can provide insights into the future of the on-demand delivery business and its players.