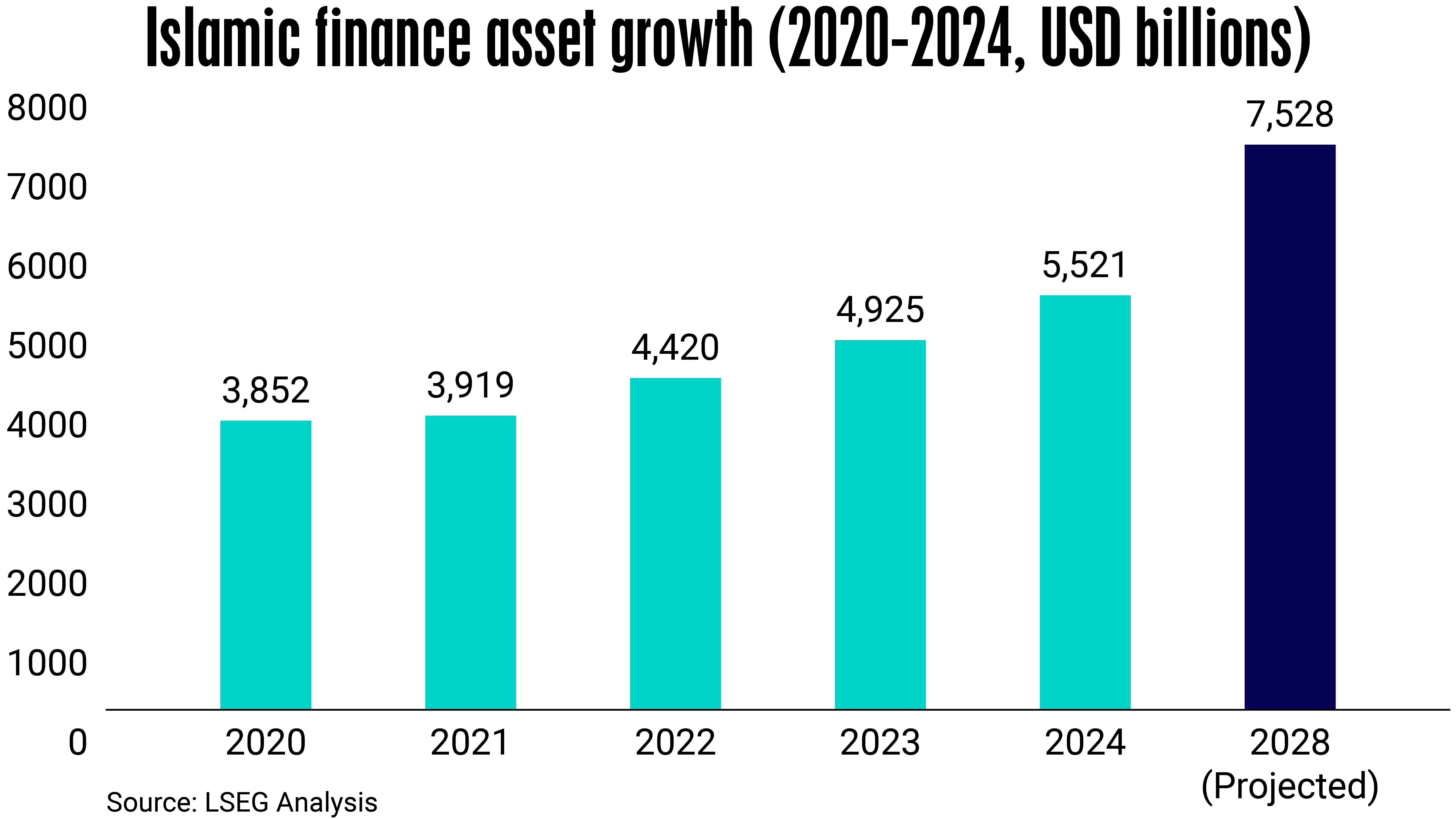

Despite ongoing economic uncertainties and geopolitical tensions, the Islamic finance industry is predicted to grow significantly in the coming years. That’s according to a recent Standard Chartered report, which expects the size of the market to reach US$7.9 trillion by 2028. The market was valued at around US$5.5 trillion last year, up 43% from 2020.

The industry has gained momentum amid increased awareness of Shariah-compliant products and a growing focus on ethical finance. Approximately 43% of surveyed Standard Chartered clients see local demand as the primary driver for Islamic finance adoption. Morever, 87% of the respondents have an optimistic outlook for the Islamic finance industry over the next five to ten years.

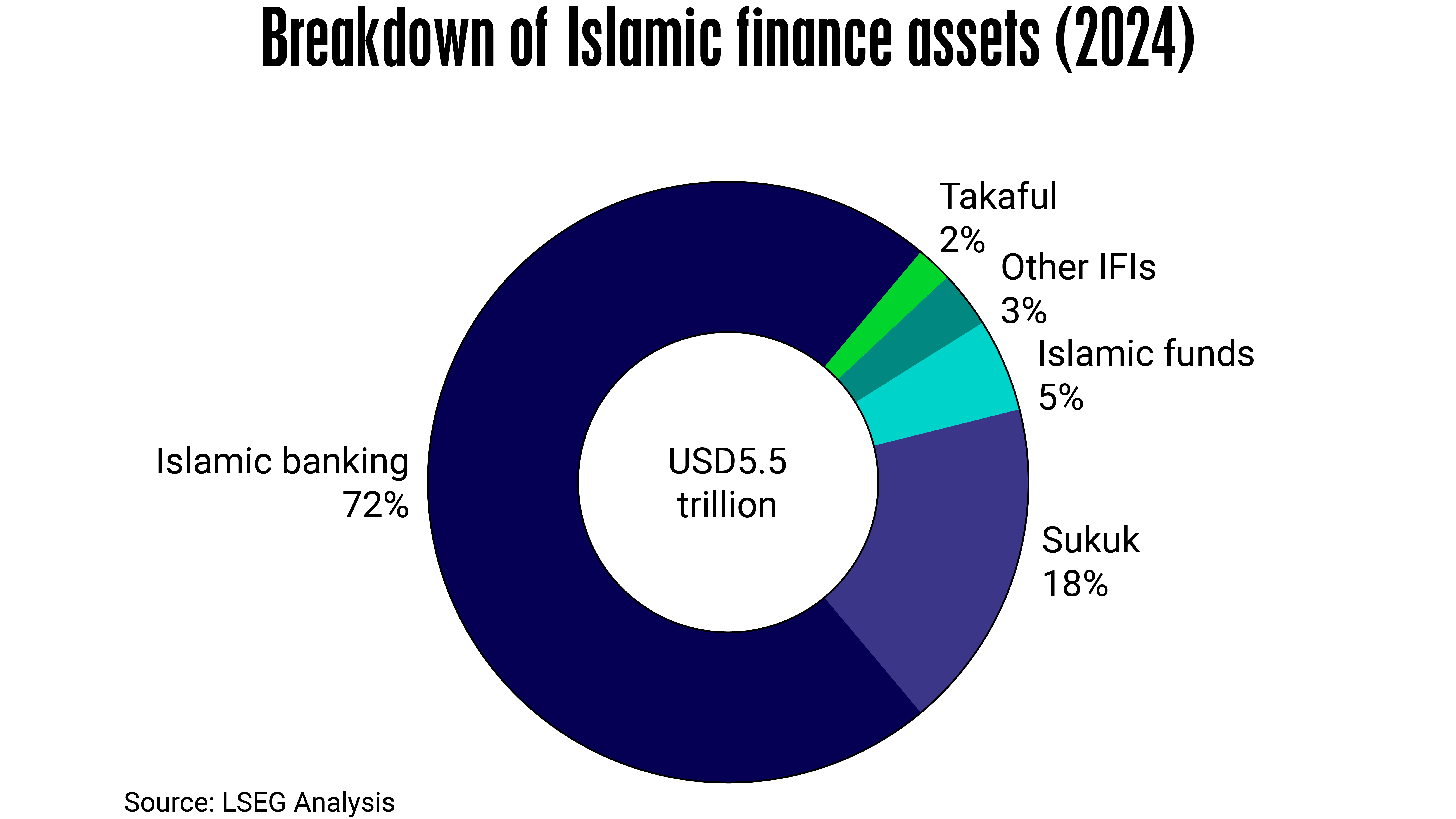

Islamic banking is the largest contributor to the industry, accounting for over 70% of global assets of around US$4 trillion in 2024, and this is projected to grow to almost US$5.2 trillion by 2028. About 85% of Islamic banking assets are concentrated in the MENA region.

“In the early years of Islamic finance, adoption was limited to a handful of markets. Now, a network of over 1,980 Islamic financial institutions delivers Islamic finance products and solutions across more than 90 markets worldwide,” states the report.

“Yet despite this expansive market reach, 80% of industry assets remain concentrated in five markets: Iran, Saudi Arabia, Malaysia, the UAE and Kuwait. The diversification of assets outside of these markets will depend on how the broader community responds to challenges and seizes opportunities in the coming years.”

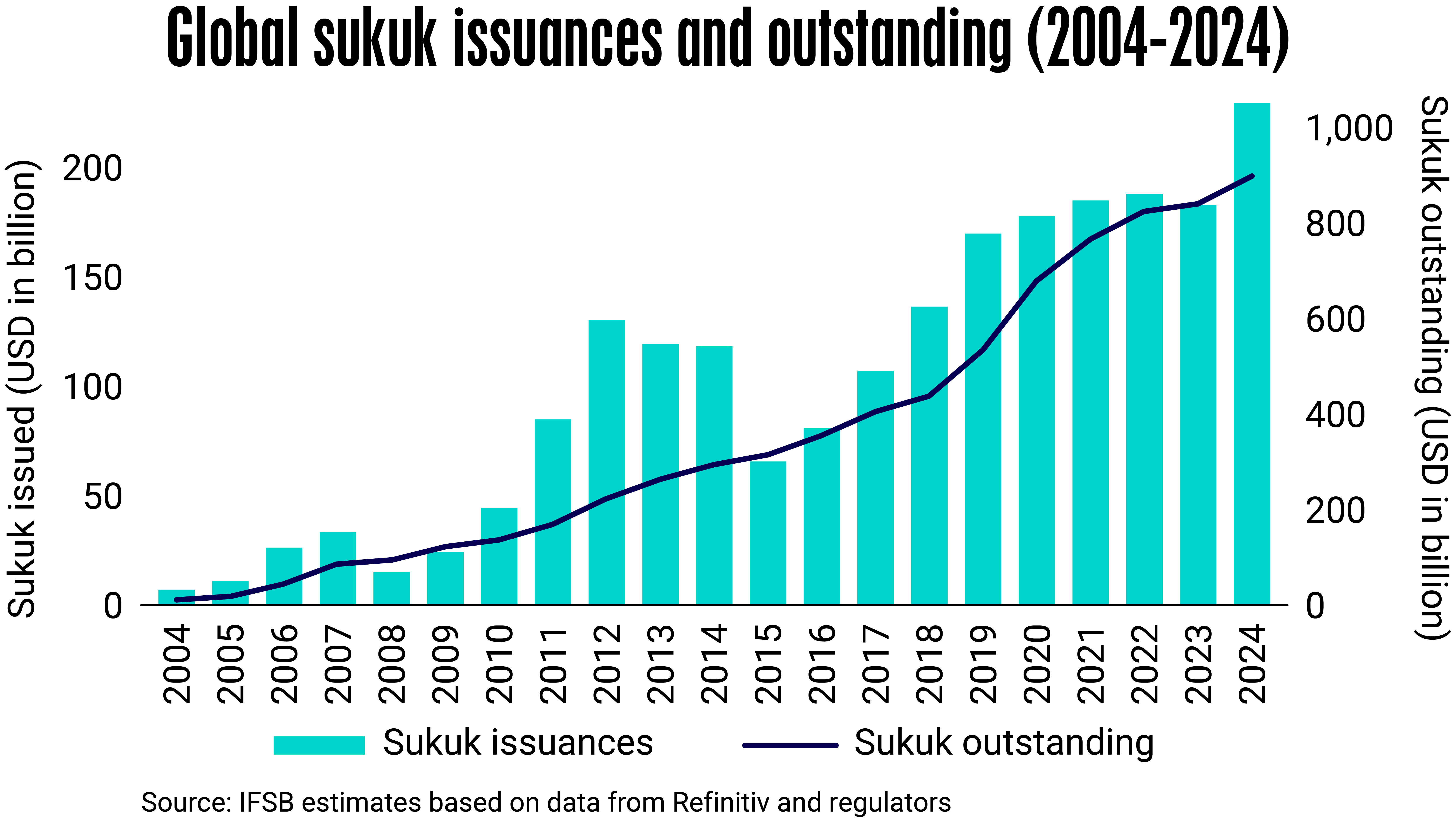

The second largest sector contributing to the overall growth of Islamic finance is the sukuk market, which had US$971 billion outstanding in 2024 and is projected to reach almost US$1.5 trillion by 2028. Though most sukuk issuance has been concentrated in Muslim majority countries across Asia, it has also seen interest in non-traditional jurisdictions such as Hong Kong, the United Kingdom and the Philippines.

A separate report published by the Islamic Financial Services Board ( IFSB ) also highlights the importance of sukuk development to the overall development of the industry, noting that new issuances were estimated to have grown by 25.6% to US$230.4 billion in 2024, compared with the previous year. While new issuance activity was dominated by public sector issuers ( 52.9% ), corporate sukuk grew 21.2% last year.

One area of excitement within the growing sukuk segment is the rapid development of ESG-themed sukuk. According to a recent Fitch Ratings research note, global ESG sukuk reached about US$50 billion outstanding in Q1 2025, up 21.6% year-on-year, propelled by funding diversification, enabling regulations, demand from Islamic investors, and ESG-sensitive investors in Europe, Asia and the United States. The industry is evolving as rapidly as the conventional market, with some sukuk issuers looking more at ESG-linked issuances than use-of-proceeds transactions.

In Malaysia, for example, Johor Plantations Group last year issued a 1.3-billion-ringgit ( US$300 million ) sustainability-linked sukuk with targets attached to carbon intensity reduction, traceability of fresh fruit bunch suppliers and annual water consumption.

While the predicted growth numbers across the Islamic industry are impressive, several hurdles have to be overcome for the market to reach its full potential. These include regulatory complexity, liquidity shortfalls, and a lack of standardization in risk management. Aligning market practices with conservative Shariah-based models remains challenging, particularly given evolving standards from the Accounting and Auditing Organization for Islamic Financial Institutions ( AAOIFI ). For instance, AAOIFI Shariah Standard 59, requiring a minimum of 51% tangible assets throughout a sukuk’s life and prohibiting direct murabaha refinancing, initially depressed issuances in markets like the UAE, though adaptations occurred.

The draft AAOIFI Shariah Standard 62, proposing the transfer of legal ownership and risks of underlying assets to sukuk holders, could further complicate issuances by increasing costs and exposing investors to asset risks, with 34% of clients in the Standard Chartered report viewing its impact positively and an equal share seeing a balanced effect.

Liquidity challenges persist amid limited Shariah-compliant instruments, shallow secondary markets, inconsistent regulations, and a shortage of short-dated sukuk.

While Shariah-compliant hedging products like profit rate swaps and waad-based arrangements are emerging, the absence of standardized cross-border guidelines limits their adoption. Enhanced awareness and education are critical to overcoming these barriers and fostering wider market participation.

“The geographical footprint of the IFSI ( Islamic financial services industry ) is expanding, with encouraging developments across banking, insurance, and capital markets. However, growth remains uneven and structurally concentrated in the banking sector and in certain regions, highlighting the need to advance non-bank segments and strengthen market development in emerging and frontier markets,” says the IFSB report.