Hong Kong’s economic lynchpin, the property market, continues to decline, with rental prices in the residential, office and retail segments on a downtrend. A potential default by a major developer can bring the residential sector down by another 7%, a market report says.

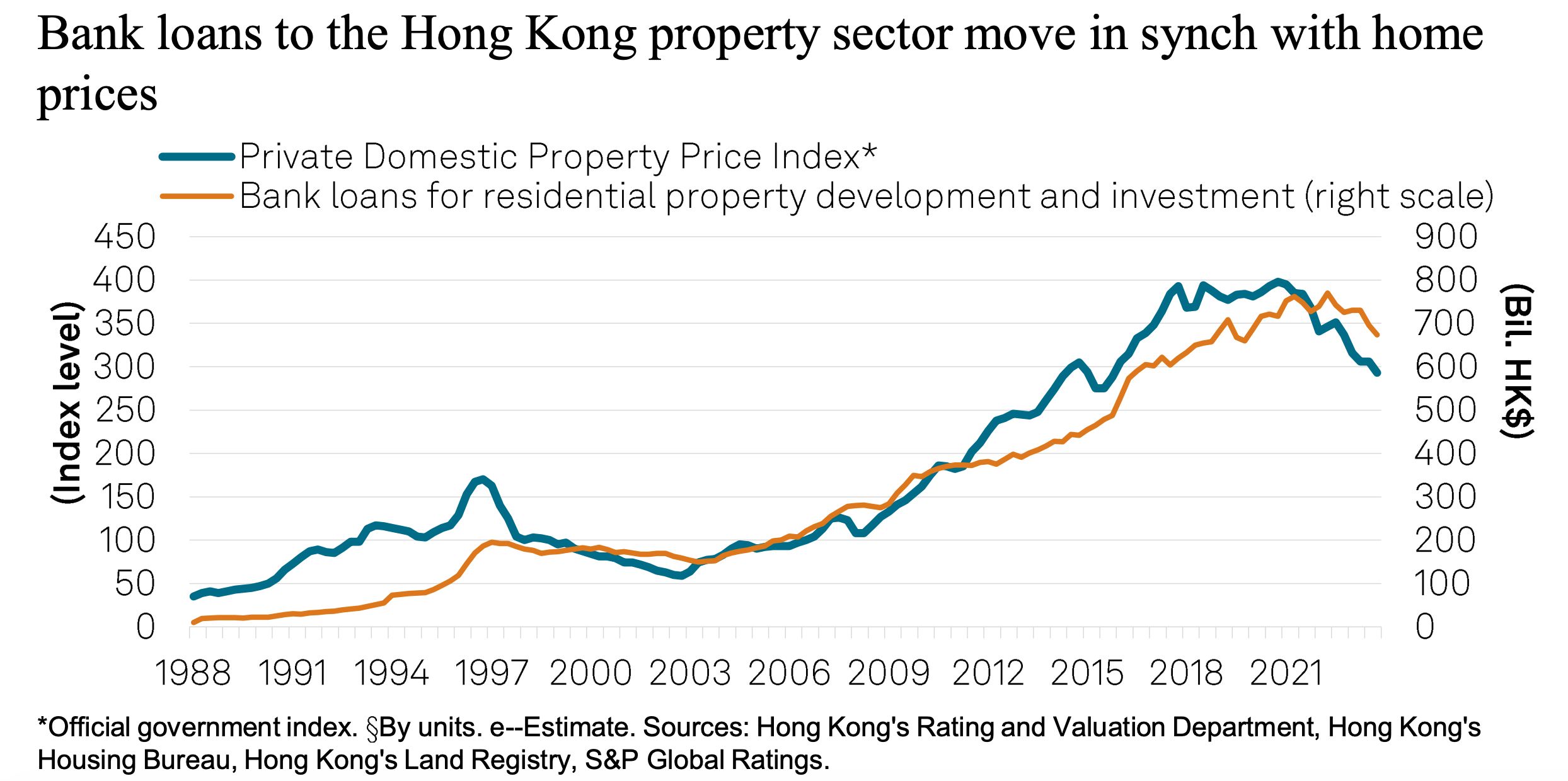

After slipping for three years in a row, home prices in the special administrative region are expected to level off at the lowest since the Covid outbreak, with 20,000 new flats projected to be sold this year. However, this estimation is based on eased mortgage rates accompanied by US rate cuts, S&P Global Ratings says in its latest report on the city’s property sector.

While the residential market has staunched its bleeding, the plateau risks reversal in view of the precarious financial condition of the city’s top developers.

The rating agency warns that a default by a major developer could trigger a domino effect on the entire sector. Such a scenario could halve new flat sales and slash flat prices by 5% to 7%.

“Even for big developers, not all of them seem to have good liquidity buffers,” says Edward Chan, director at S&P. “Although a default from them is not included in our base case, it is not completely out of the question. If Hong Kong’s residential property market downturn continues, unrated developers with thin liquidity buffers might fail to raise enough funds through alternative means, and it’s possible for big names to run into financial distress.”

Consequently, developers may resort to price cuts to boost sales while reducing their investments to maintain a safe debt ratio. But even such measures may not help much if banks tighten lending amid flagging home prices, according to the report.

Financially distressed developers may need to tap unsecured bank loans or seek funding from controlling shareholders if banks slam the door on them.

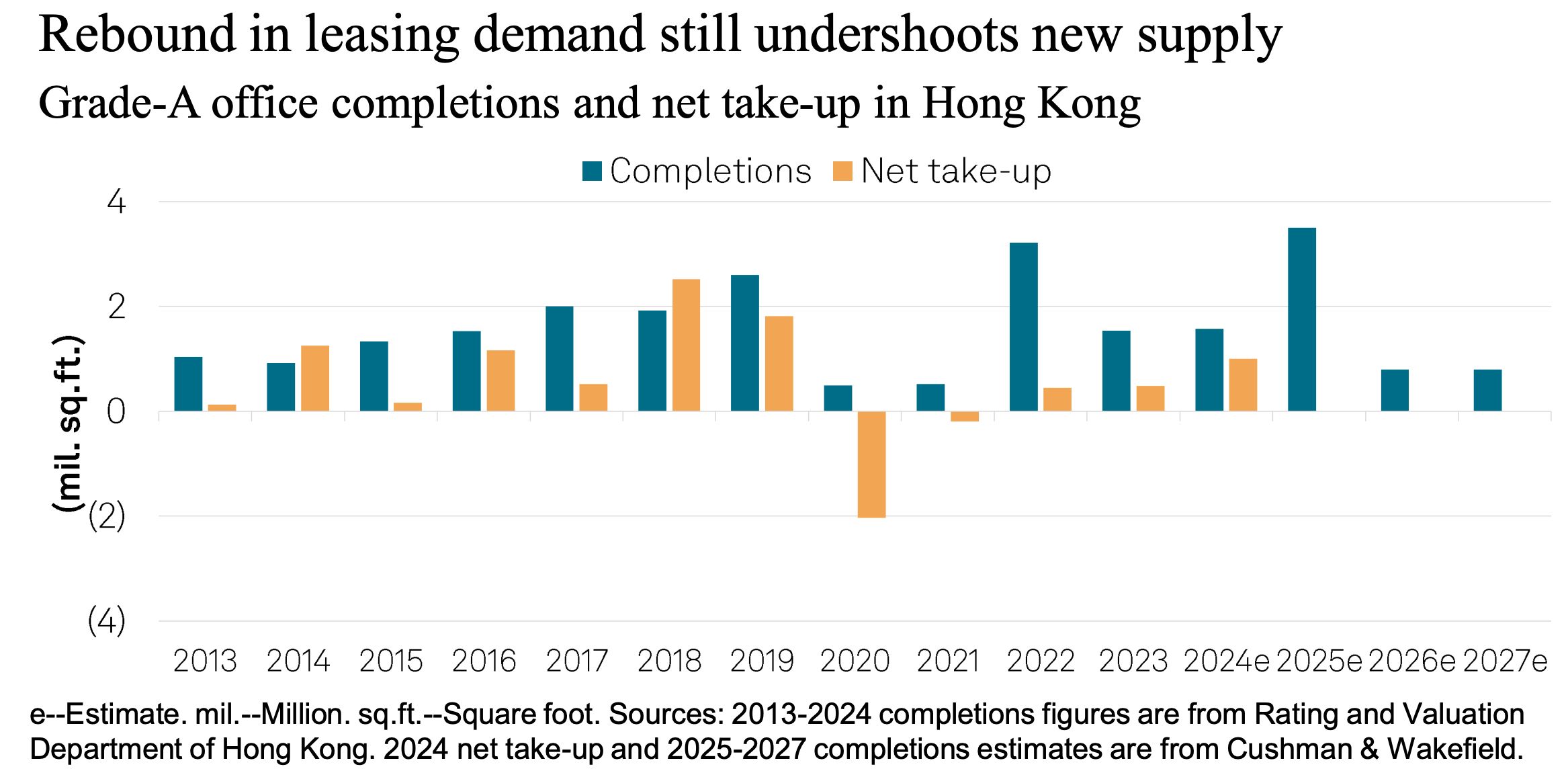

Meanwhile, commercial real estate is also under pressure amid an office glut. Only 1 million square feet of office space was absorbed by the market in 2024, and a fresh supply totalling 3 million sq ft is set to be released this year, a high level not seen in 17 years.

Office rents have been on a downtrend since 2020 and, according to S&P projections, would fall by another 8% to 10% this year, with grade-A vacancies estimated to rise above the level at 13.2% from end-2024.

Commercial landlords face stiff competition as new buildings enter the market, resulting in dented property values eroding their debt-capital ratio. Investment-grade developers, however, can maintain a low leverage ratio, with banks prioritizing the funding needs of those with quality assets.

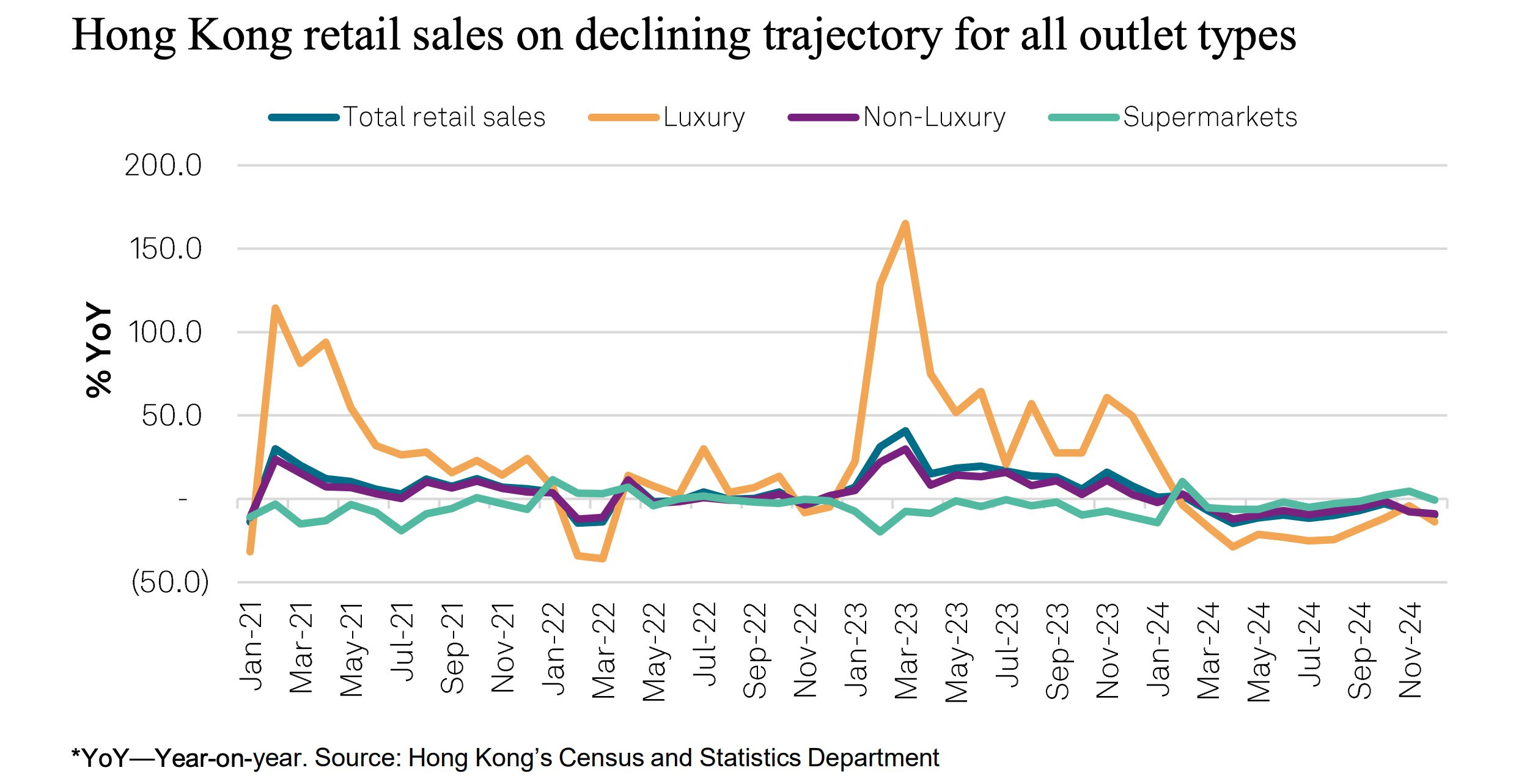

The retail sector, meanwhile, is taking a severe hit from reduced consumer spending in the face of cross-border offerings and e-commerce discounts, as well as a strong Hong Kong dollar that has tempered spending from outside the region.

To preserve occupancy rates, landlords may give as much as 10% discounts on retail rents, even in premier malls. Rent cuts are likely to be worse in the case of weaker players who lack the flexibility to diversify tenant mix and invest in asset enhancements.

“Book valuations on landlords have been fairly sticky, as a prolonged downturn puts the valuation at a riskier position,” comments Wilson Ling, associate director at S&P. “Developers who take a more aggressive view on valuation, such as taking an aggressive view on lower cap rates or stronger view on future cashflows, can face bigger risks.”