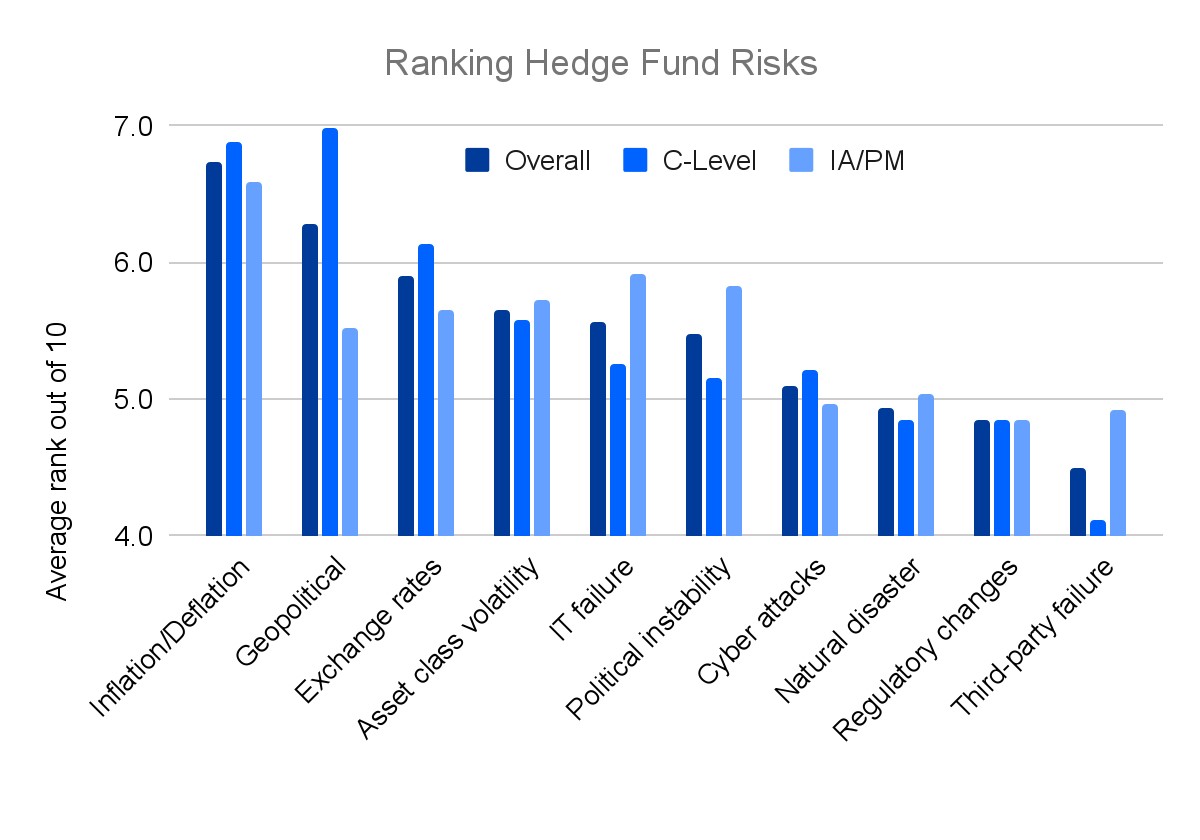

Overall, inflation or deflation and geopolitical issues are considered to be the top two risks faced by senior hedge fund executives, followed by exchange rates and asset class volatility; and they are least concerned with third-party failures and regulatory changes, according to a recent report.

As well, as hedge funds navigate global risks and volatile markets, executives are concerned about maintaining control of model and algorithm changes and building a greater understanding of overall exposures, finds the research report by fintech Beacon Platform. The fintech surveyed 100 executives in the US, UK, Germany, Switzerland, France, Italy, Sweden, Norway and Asia, with responsibility for a collective US$901 billion of assets under management.

IT failure was a notable difference between the C-Suite respondents and their investment analysts ( IA ) and portfolio managers ( PM ), with the latter group ranking it as their second-biggest risk.

Furthermore, the largest funds, with assets under management between US$25 and US$50 billion, are much more concerned about inflation or deflation ( 8.7/10 ) and geopolitical instability ( 8.1/10 ), rating these issues 30% higher than the overall group.

Risk management challenges

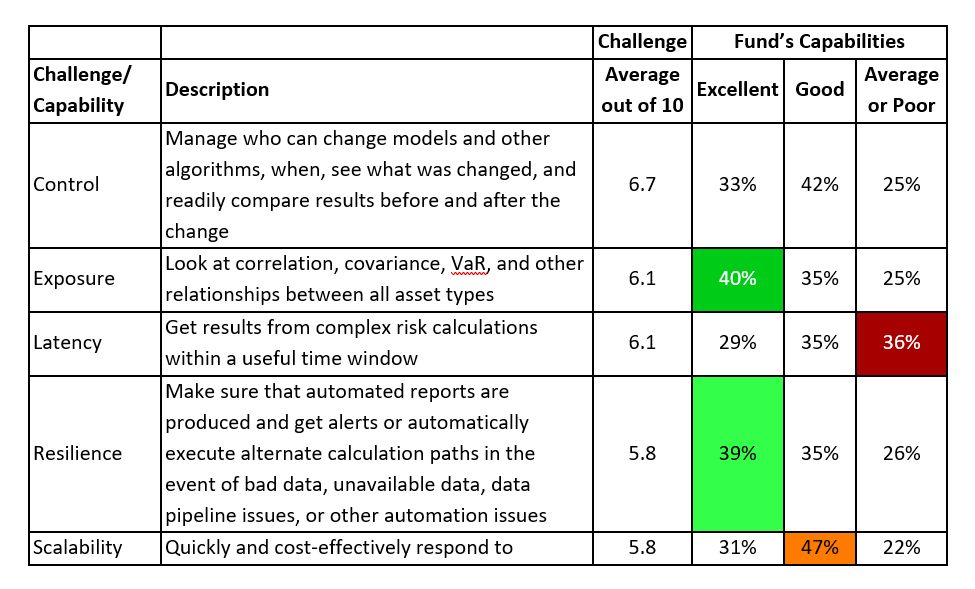

The group was asked to rank a key set of risk management challenges faced by hedge funds, and then to rate their own systems against each challenge. Control of models and algorithms is a clear leader as the biggest challenge, followed by understanding the fund’s overall exposure and having minimal latency when getting results from complex risk calculations.

When rating their own systems, on average the group think they are best at getting coverage of all traded products in the same system and worst at calculation latency.

Table: Rate the following risk management challenges hedge funds are currently facing, and your fund’s capabilities in that area. Highlights show the highest ranking challenges for each column, emphasizing the biggest challenges for each set of funds with a similar capability level.

Concerns, capabilities vary

As hedge funds increase in size, it is not surprising that their top challenges and capabilities will change. The smallest funds surveyed, those with less than US$1 billion in assets under management, are most concerned with accuracy, exposure and adaptability as they build and improve their risk management systems.

The middle group, with assets between US$1 billion and US$10 billion, shift their focus to model control, calculation latency and overall system resilience, as they work to handle more models and run calculations for a greater variety and complexity of assets.

And the biggest funds, with assets between US$10 billion and US$50 billion, want to ensure that they are including full coverage of their broad portfolio of assets, calculating accurate and appropriate information about their exposures, and getting results from these complex calculations in time to be actionable.

“As geopolitical risks continue to grow and bring with them renewed threats of inflation or deflation and increased volatility,” says Kirat Singh, Beacon Platform’s CEO and co-founder, “our research shows that hedge fund executives are turning their attention towards the capabilities that they will need to prosper in this environment.”