The global hedge fund business returned +1.58% in December 2021, bringing the aggregate return for the industry for the year to +10.00%, according to just-released data from eVestment, a market intelligence provider under Nasdaq.

Almost 80% of funds reporting to eVestment posted positive results for 2021, with the average positive return coming in at +15.55%. For the small minority of funds that landed in the red for the year, the average return was -7.32%.

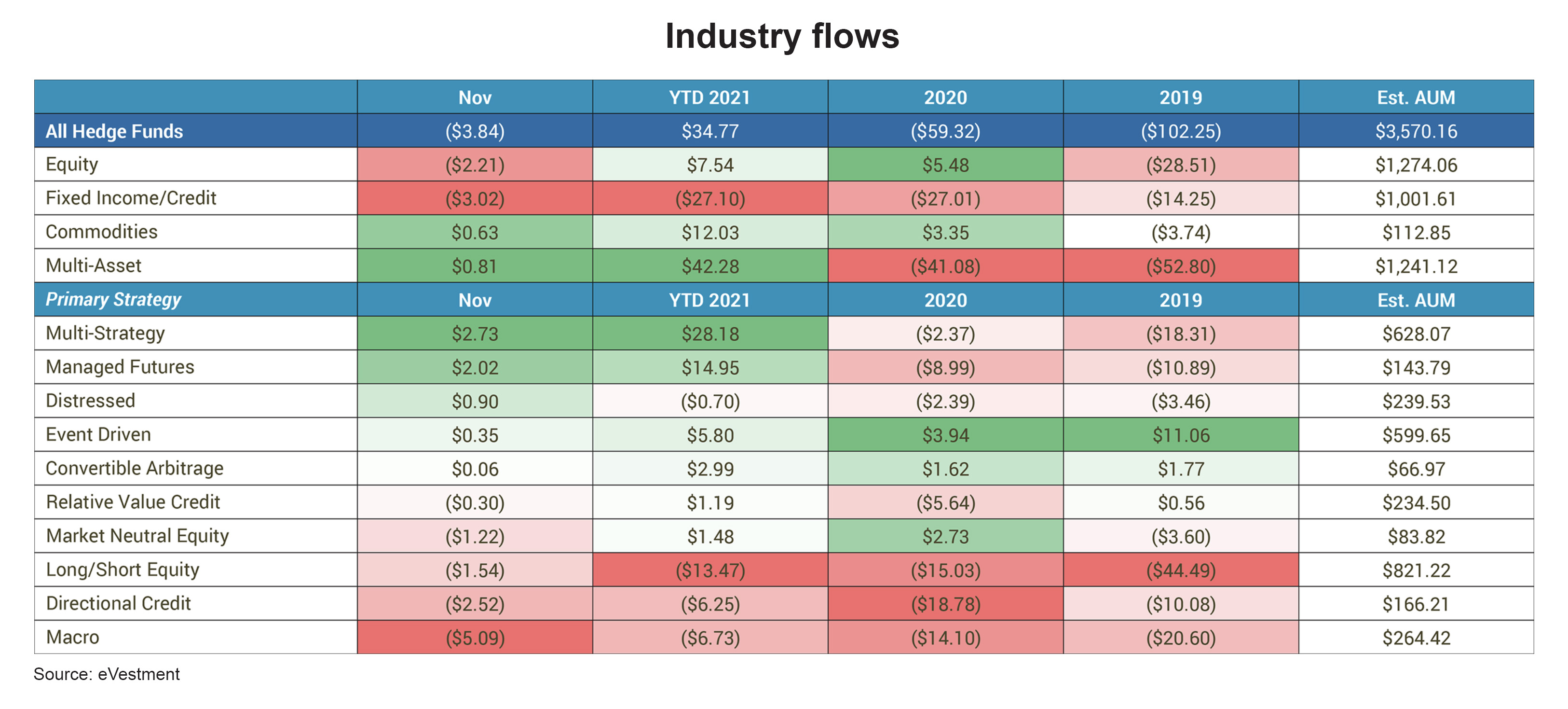

Investors rewarded the hedge fund industry’s strong performance in 2021 with significant inflows. Through November of 2021, investors plowed US$34.77 billion into the business. That new money and positive performance brought assets under management ( AUM ) for the industry to US$3.57 trillion through November.

“It’s easier to talk about the fund types that underperformed in 2021 since positive performance was so widespread last year,” says eVestment global head of research Peter Laurelli. “Brazil-focused funds posted the largest aggregate negative return in 2021 at -18.64%. China-focused funds also posted aggregate negative return in 2021 at -7.11%. Insurance-linked funds and FX/currency funds also ended the year in the red, but just barely. Generally, though, it was a good year for the business.”

Here are some of the biggest performance winners for 2021: